Accounting is the most time-consuming aspect of running a business, but whether we like it or not, it is unavoidable.

And as law-abiding citizens, we must have our finances in order and be ready for tax season to ensure the smooth operation of our online business. Therefore, establishing taxes and tax rates is one of the first tasks you should complete when opening a store.

Fortunately, numerous automated tax options work with WooCommerce, and don’t worry; we’re here to assist you in selecting a WooCommerce taxes plugin, configuring it, and getting it done once and for all.

So, let’s dig in!

Seven WooCommerce Tax Plugins to Simplify Taxation

Here are the top seven best WooCommerce tax plugins for automating your WooCommerce store’s entire tax maintenance process.

WooCommerce Shipping & Tax

The WooCommerce Shipping and Tax plugin is created by the same organization that created WooCommerce. This plugin improves the shopping and selling experiences for both sellers and buyers. But, first, let’s go over the main features of this sales tax calculations plugin.

- Automated tax calculation;

After enabling tax settings on the WooCommerce settings page, the WooCommerce Shipping and Tax extension can collect automated tax on every purchase.

- Dependable hosting;

Automattic hosts the sales tax information collected from each purchase on its servers. As a result, your WooCommerce store server remains lightweight, fast, and secure.

- Transaction security;

This plugin uses PayPal Express Checkout payment gateway authorization to process the payment portion. As a result, it ensures the most secure payment process while making transaction tracking more accessible than ever.

- Printing of shipping labels;

Using this plugin/, you can add USPS and DHL labels to your customers’ invoices. By the way, USPS only accepts domestic orders within the United States. Use DHL to send invoices all over the world.

Try the Challan plugin to create a professional-looking invoice with tax information. In addition, Challan can quickly generate PDF invoices and packing slips.

- Supported countries;

This plugin can reduce your tax burden for potential customers in 31 countries. They plan to add more countries shortly. Right now, the following countries are supported.

| United States of America | Denmark | Lithuania | Finland | Poland | Latvia |

| United Kingdom | Luxembourg | Australia | Cyprus | Germany | Estonia |

| Netherlands | Slovenia | France | Austria | Slovakia | Romania |

| Czech Republic | Spain | Greece | Italy | Portugal | Ireland |

| Bulgaria | Hungary | Belgium | Canada | Croatia | Malta |

TaxJar

TaxJar is one of the most widely used solutions for automating sales tax calculations on your WooCommerce store. It will always provide accurate tax calculations, regardless of the workload or traffic on your site. For example, the economic nexus calculation may be complicated if your company is based in the United States.

TaxJar, on the other hand, will make it a breeze thanks to its database of over 14000 taxing jurisdictions. TaxJar also offers automated return filing and AI-enabled tax categorization.

Main features of the plugin:

- Manage sales tax calculations for multiple locations with ease;

- Great insights into the economic nexus;

- Simplify tax filing and reporting;

- Return filing automation;

- It is simple to manage with an onboarding team, an account manager, and 24/7 support;

- TaxJar integration plugin for WooCommerce is free.

WooCommerce Taxamo

This plugin connects your WooCommerce store to Taxamo, a VAT calculation service for European Union stores. It will send information about the items in a Cart to Taxamo, which will return tax details before the customer checks out.

The plugin also aids in the collection of evidence and the registration of payments. You will also be able to generate returns and audit files quickly.

Main features of the plugin:

- Connect your WooCommerce store to Taxamo, a popular EU VAT Calculation service.

- The checkout page returns an accurate tax value based on the products and the customer’s location.

- Aids in the generation of downloadable returns and audit files.

- It easily captures location evidence.

WooCommerce AvaTax

This WooCommerce plugin allows you to connect your WooCommerce store to Avalara AvaTax. As a result, you can automate the sales tax calculation for each purchase made on your WooCommerce store.

Furthermore, you will find excellent assistance with tax filing and returns. For example, instead of manually entering rates into your WooCommerce tax settings, you can have the tax rates calculated based on the customer’s location and your store’s base location. You will also receive a free Sales Tax Risk Assessment, which will determine the sales tax nexus created by your business.

Main features of the plugin:

- Calculate Sales Tax for your WooCommerce transactions automatically.

- In addition, filing and return processing is also automated.

- There is no need to enter different tax rates manually.

- Minimal configuration steps and seamless integration with WooCommerce.

- Address validation is only available in a few countries.

- A free trial is provided.

- Comprehensive documentation and dependable support.

YITH WooCommerce EU VAT, OSS & IOSS

This plugin will assist you in automatically calculating sales tax for your eCommerce transactions based on the customer’s location. It also ensures that you comply with EU regulations when sending digital goods.

Furthermore, the plugin will assist you in not charging taxes to customers who have a valid VAT number. You can even personalize the messages that appear when a purchase is denied. Furthermore, the plugin requests address confirmation if the billing and IP addresses do not match.

Main features of the plugin:

- Identify and display tax calculations based on the customer’s location automatically.

- Prevent the customer from purchasing.

- When customers are unable to complete a purchase, a notification is displayed.

- Make the VAT number field required.

- If there is a mismatch between the IP address and the billing address, ask the customer to confirm the country.

- VAT rates from all European countries can be imported with a single click.

- Create a report that includes all transactions from which tax was deducted.

Simple Sales Tax

This plugin will assist you in connecting your WooCommerce store to TaxCloud. In addition, it will aid in automating tax calculations, reporting, and filing. This plugin also allows you to manage tax exemptions at the product and customer levels.

Main features of the plugin:

- Calculate sales tax in the United States automatically.

- Features for advanced reporting.

- Aids in the provision of tax breaks for customers or products.

Tax Exempt for WooCommerce

This plugin can provide tax exemption for specific customers or user roles. In addition, the plugins provide you with a customizable form that you can display on your store and through which customers can request tax exemption.

Customers can use this form to submit the necessary files and information. You can validate the information and notify customers whether their request has been approved. The plugin provides a checkbox on the Checkout page to assist customers in claiming tax exemption.

Main features of the plugin:

- Allow specific customers and user roles to request tax exemption on your WooCommerce store.

- On the My Account page, show a customizable tax exemption form.

- Examine the tax exemption request and display the status.

- Store managers will receive an email notification when a new bid is submitted.

- Customers will be notified via email when a decision is made on a request.

- Allow direct tax exemption from the administration.

- Details about tax exemptions will be included in order pages and emails.

- In addition, tax exemption is available to guest users.

How to Configure WooCommerce Automated Taxes

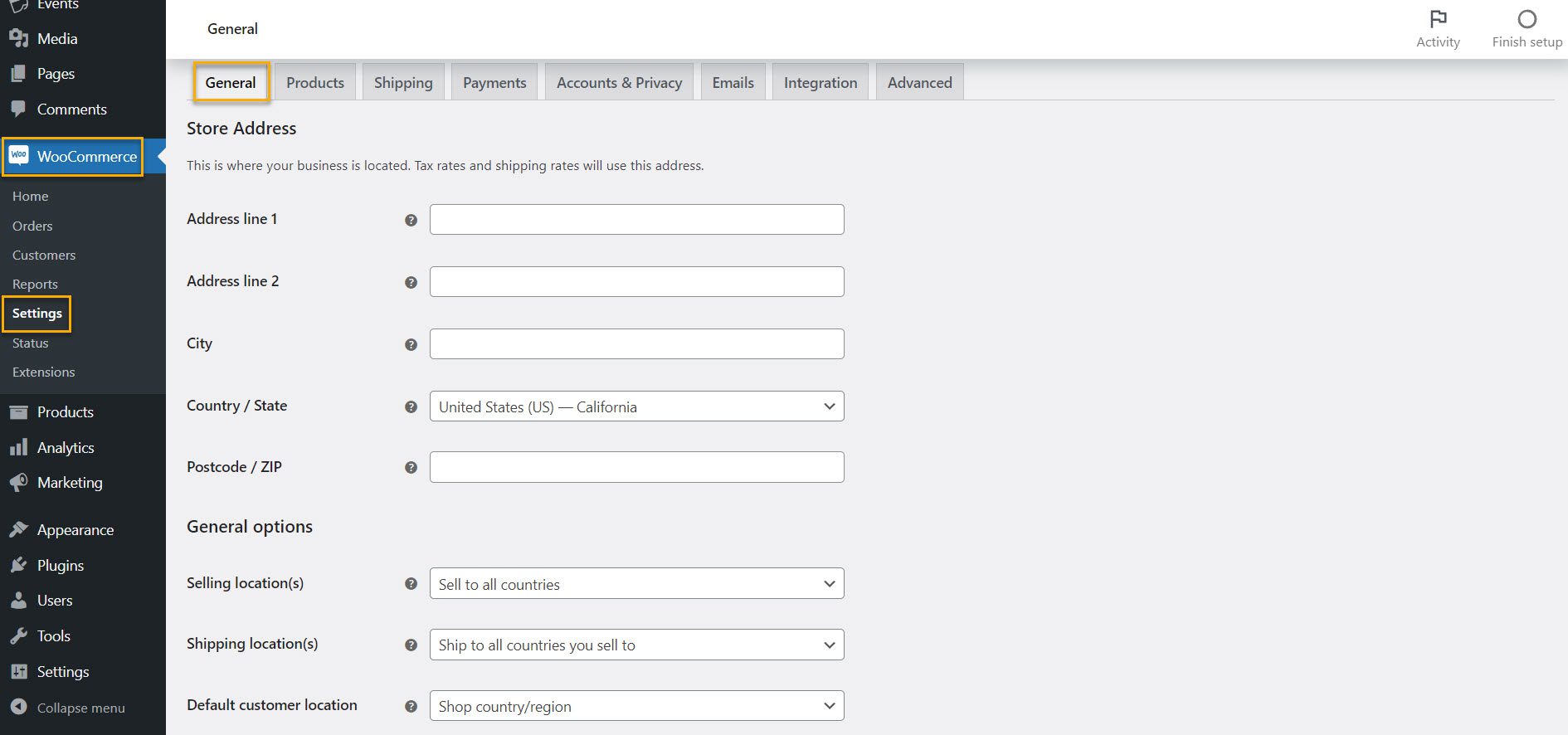

Step 1: Enable automated tax calculations.

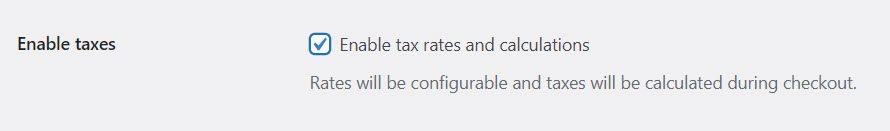

To enable Automated Tax Calculations, head to WooCommerce → Settings → General.

Then scroll down to the bottom and check the box next to Enable taxes and tax calculations. Remember to hit Save Changes before you exit this page.

Step 2: Enable automated taxes.

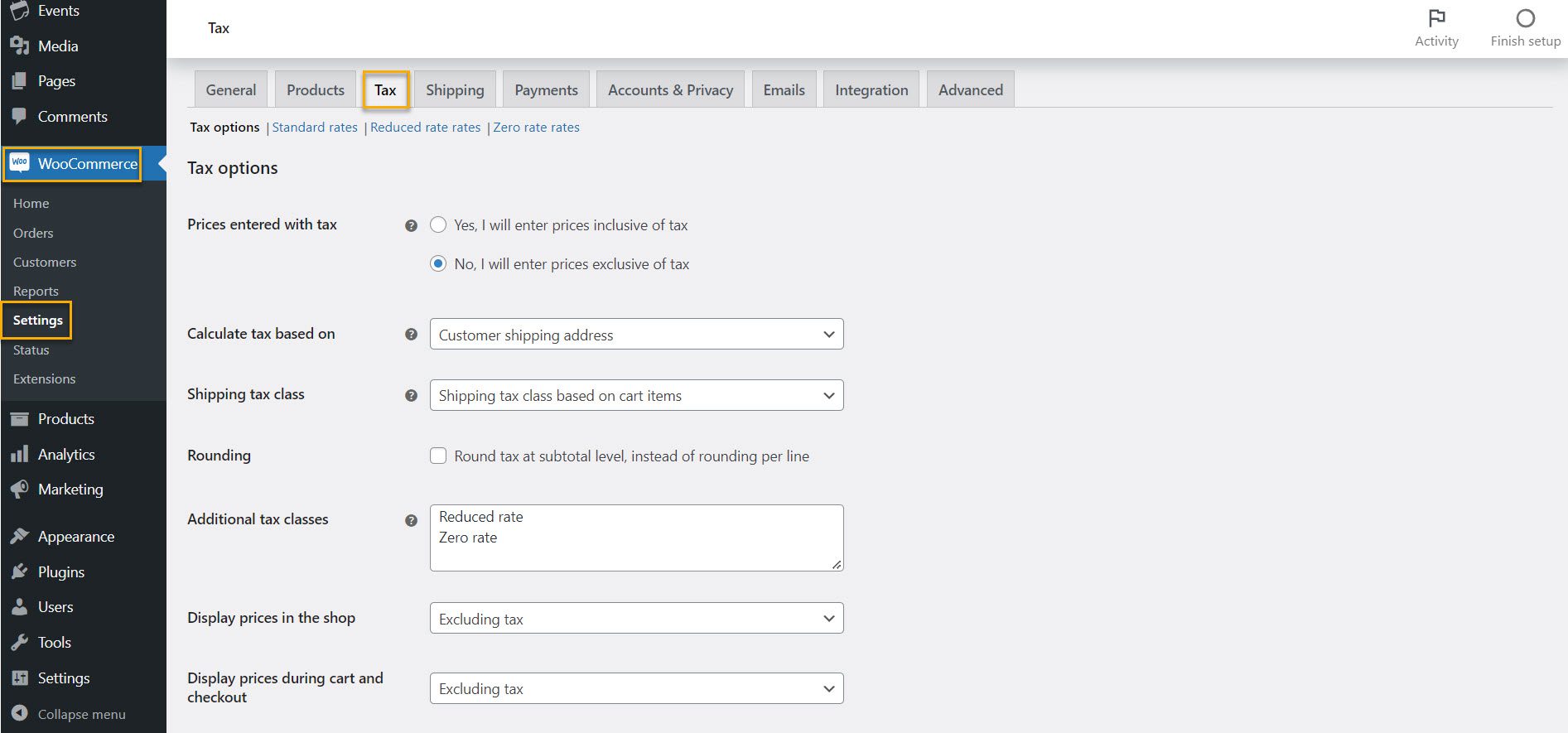

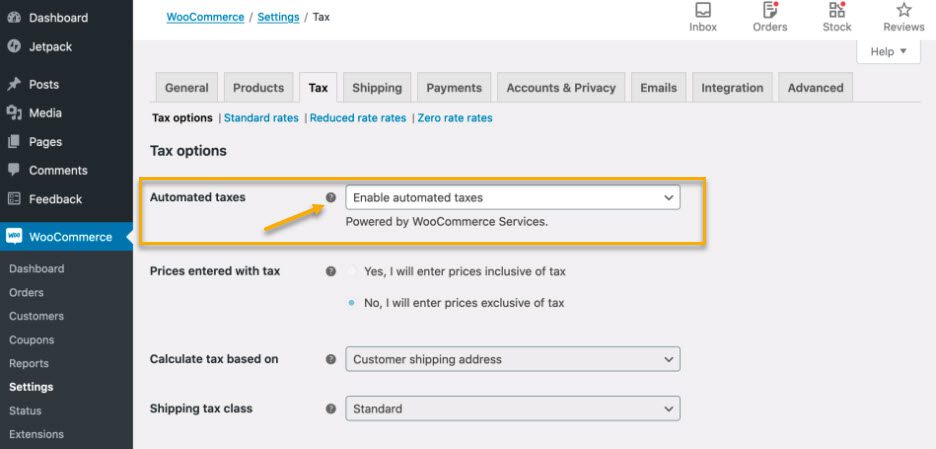

For this, navigate to WooCommerce → Settings → Tax.

Then check Enable automated taxes, as shown below, and hit Save Changes once done.

Step 3: Configure the settings.

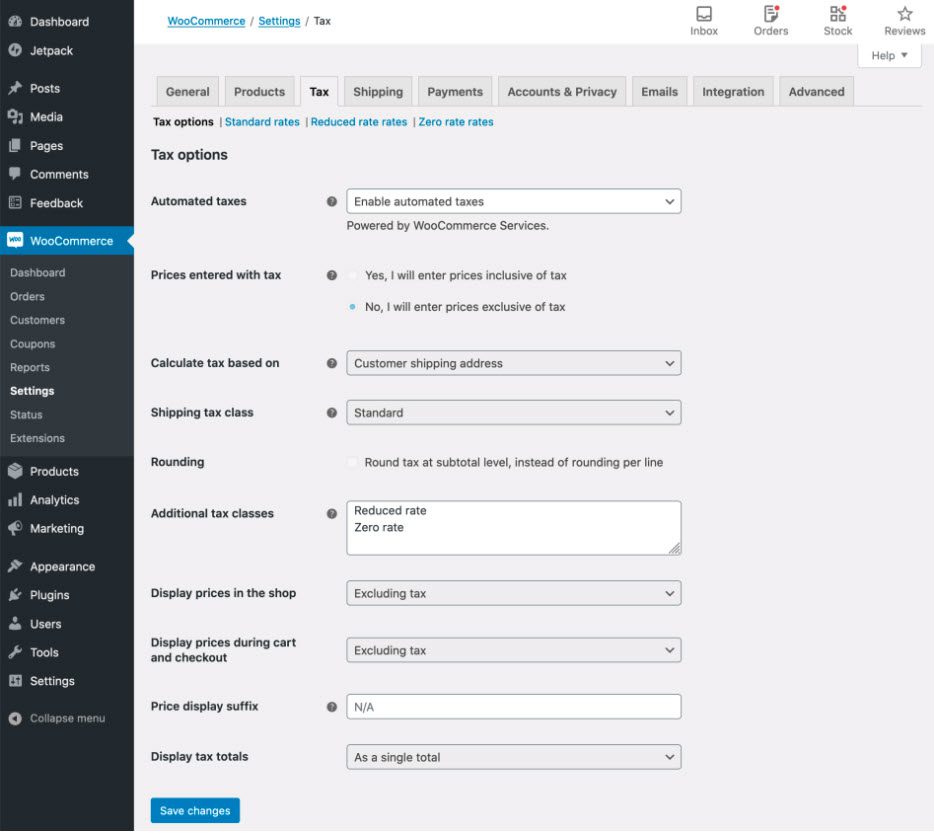

Now go to WooCommerce → Settings → Tax.

When you enable Automated Taxes, many settings are disabled because the WooCommerce core tax settings replace them. This means that the Display prices will be set to Exclude tax, and tax will be calculated based on the customer’s shipping address.

When Automated Taxes is enabled, it overrides any manually added tax rates and the Compound and Shipping toggles for those tax rates.

Issues that may or may not occur with WooCommerce automated taxes

Automated taxes do not calculate like they are supposed to.

Even if the tax value of an order is zero, Automated Taxes may be working correctly. For example, assume your company is headquartered in the United States. In that case, you must only collect sales tax from customers in areas where you have a “Tax Nexus,” typically defined as a physical presence. In WooCommerce > Settings > General, your store address is treated as your “Tax Nexus.”

“Nexus” is the required contact between a taxpayer and a state before the state can tax the taxpayer. Before the United States, According to the Supreme Court’s decision in South Dakota v. Wayfair in 2018, a physical presence in the state is required for sales and use tax nexus.

Furthermore, if your annual dollar value or order total to that state exceeds a certain threshold, you may have a “Tax Nexus” in that state. If you have any questions about your Tax Nexus, you should seek the advice of a certified local accountant.

Your store has moved to a different state.

If you need to change your store’s address to another state, you must first do that in the settings.

WooCommerce Services uses your store address, which can be found in WooCommerce → Settings → General, so you must update this setting to reflect your store’s new location.

Furthermore, any data added to the Standard tax rates tab in WooCommerce > Settings > Standard tax rates must be deleted. When using automated rate rates, remove the default rates to reset the plugin to the new location.

Wrapping Up

And there you have it! We’ve gone over every step required to set up WooCommerce Automated Taxes. Remember that your taxes are automatically determined by your legal obligations and selling location.

WooCommerce provides several options for setting up taxes in your store by default. You can display prices inclusive or exclusive of tax, calculate taxes based on the location of each customer, add tax rates for different countries and regions, and much more.

We hope this article has made taxes less painful and more enjoyable for you. Feel free to check our blog for more infos.

Gabriella is a Digital Content Writer and Marketer with a zeal for all things WordPress. When she’s not researching and drafting the upcoming articles, you can find her in the open air exploring the outdoors with her dog.

Comments are closed